What is an Individual Taxpayer Identification Number (ITIN)

An Individual Taxpayer Identification Number (ITIN) is a unique identifier for tax purposes provided by the Internal Revenue Service (IRS). ITINs are allocated to individuals who need a U.S. taxpayer identification number but cannot acquire or don't qualify for a Social Security number (SSN) from the Social Security Administration (SSA).

To apply, complete Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), with your federal income tax return. It's essential to include original documents or certified copies from the relevant authority to verify your identity and foreign status.

Unfortunately, Tulsa Responds no longer assists with ITIN applications.

We encourage you to seek services from a Taxpayer Assistance Center or a Certifying Acceptance Agent. Both will help you apply for an ITIN without needing to mail off your personal documents.

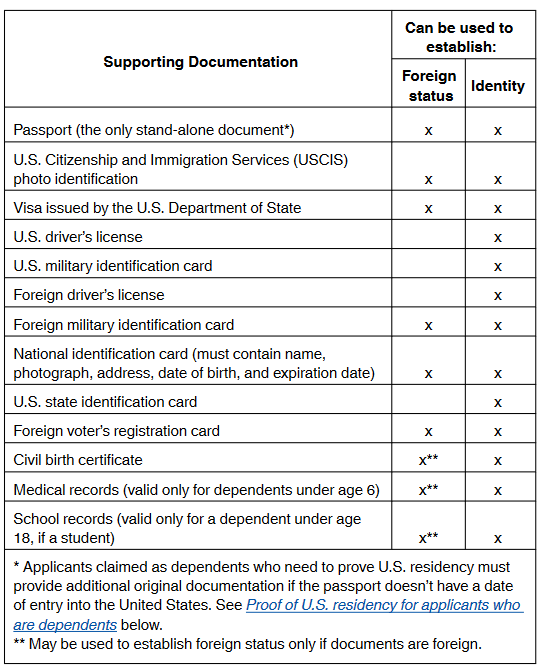

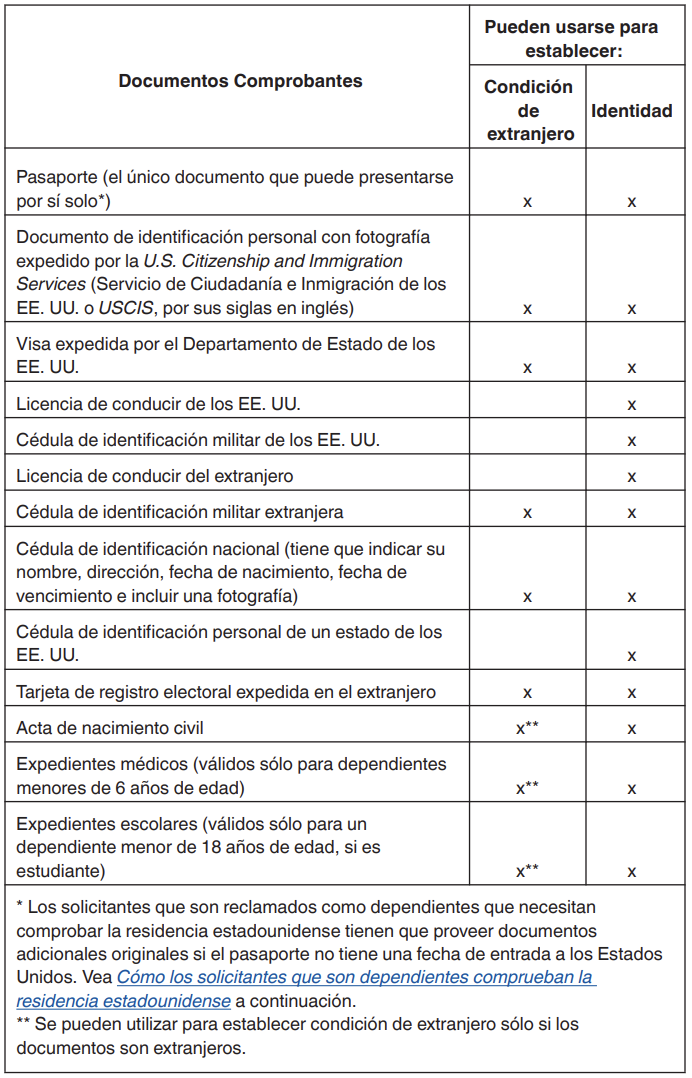

REQUIRED DOCUMENTS What do I need to apply for an ITIN?

Below is a list of supporting documents you will need to submit an ITIN application or renewal.

For more information what documents are accepted by the IRS, visit their website, here.